Targets – broadly met

Yesterday I was looking

for sp'1355/60 'best bullish case'...we hit 1354....that is close enough

VIX breaking under 20

was as expected, and for the bears..at least it didn't break down too

severely.

SP'60min cycle, looks

pretty high, and offers some reasonable downside tomorrow and/or Friday.

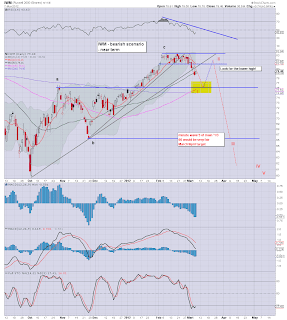

IWM Daily - bearish case

Bearish case: still looking for 76 in the immediate term. It does look VERY likely that we'll bounce off 76 sometime by opex. Right now, any subsequent bounce would likely be restricted to around the 10MA - currently 81 (79 middle of next week)

VIX - Daily, Bullish outlook

VIX got the expected whack treatment today to close a touch under the 50 day MA. If market moves up to around sp'1360, then VIX could briefly hit the rising 10MA - which will be around 18.50 at the Thursday open.

--

Bigger Picture - the Dollar (via UUP), weekly cycle

UUP still suggesting we're starting a new bullish wave for the $. We'll know soon enough.

-

Derivative problems - TVIX

TVIX had a bad day yesterday. With the VIX up over 20%, TVIX managed just a 4% rise. Yes, TVIX does NOT measure the exact same thing as the VIX itself does, but it should be reasonably close..and 2x !

Volume in TVIX has certainly fallen back sharply. Today's loss of almost $1 is a little concerning. What matters is when the VIX hits 25....will TVIX have adequately replicated the move?

A new rival to TVIX... UVXY

Is this where the old TVIX players are moving their VIX money to? Volume is substantially increasing.

-

Well, that's all for now, maybe a bit more later tonight.

We have the Greek PPI matter to be resolved. The announcement is rumoured to be around 3pm tomorrow, or maybe sometime Friday. Knowing the Greeks, they'll somehow manage to delay it until after the weekend.

Regardless, I am pretty content being short right now.

Good wishes