IWM (representing Rus'2000 small cap)

After slight weakness in July, the R2K climbed 3.5%, a pretty impressive amount considering it was a quiet month. Its clear, all those 'doomer bears' out there need IWM <75 to have any real hope of greater things.

Nasdaq Comp

Tech remains the strongest sector, no doubt lead by AAPL, which itself remains undervalued by around 40% relative to the broader market. No sign of weakness here.

Dow

Like most other indexes, the dow is back around key resistance. Only with a break under 12600 can the bears start to claim something might be changing in the bigger cycles.

As things are, if there is no decent sell side volume this September/October, then the bots will remain in control, and we'll see dow 14k..if not higher - since QE3 is coming.

NYSE Comp

The master index certainly looks tired. Near term trend IS still certainly up, but until we can break the March high of 8327 - some 4% higher, we could be getting stuck.

The NYSE looks like many of the world index charts (see VEU, GDOW), the whole formation could easily be a giant H/S formation. For the moment though, general trend is indeed...UP.

Sp

The Sp' remains a leader, and we've seen a new high of 1426 put in. A very natural next target would be the upper bollinger band on the monthly of 1451. That looks easily within reach if there are no market scares this September.

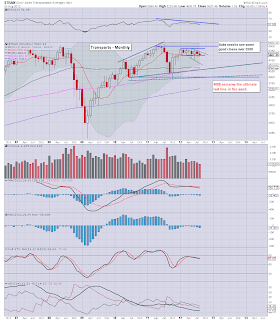

Transports

Summary

August provided pretty reasonable gains on all indexes (except transports), and we're close to taking out new (post 2009) highs. The broader market most certainly remains on an upward trend.

The Transports, aka, 'old leader' continues to show moderate weakness, although it failed yet again to close outside of the narrow range that its been stuck in since January. It remains pretty remarkable, and I will note once again, the direction in which the transports eventually decides to take, will be a pivotal signal for the broader market.

We can be clear about this much, so far the transports is utterly failing to confirm the dow, and the strength seen in other sectors/indexes. Its certainly a somewhat bearish indicator, but unless we see a monthly close <5000, bears really should not be confident.

So, it can be said that the immediate equity market trend is still broadly upward, but we are at key resistance, if there are any upsets (especially in the EU), then this market will be vulnerable to breaking the ascending trend line - equivalent to sp'1350, and then the door would be open for a swift move to the low 1200s.

To all those who say the market can't..or won't be 'allowed' to fall because there is an election coming, I can only say...

I refer you to autumn 2008.

--

*More later on Sunday/Monday.

Goodnight from London (catch me at 1.04 in the following ISS footage compilation)