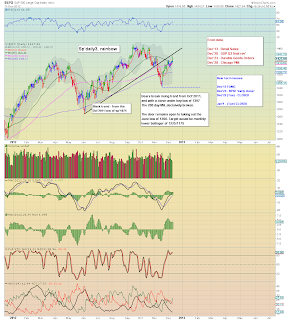

Today's moderate index gains were really hard to stomach, not least with the brief break into the 1430s - level we've not seen since the post election snap lower. It remains very possible we are still in the process of back testing the (now broken) rising support from the Oct'2011 lows.

sp'daily3 - news to come

sp'weekly2, rainbow

sp'monthly3, rainbow

Summary

The Sp' closed @ 1427, although it did trade as high as 1434. I was occasionally checking the monthly rainbow (Elder Impulse) charts through today, and despite the gains, they held their provisional warnings, via blue candles.

So, despite the latest mini ramp from sp'1398, we have still not lost the weakness as indicated on most of the monthly rainbow index charts.Yet, any bear out there really should still be seeking a monthly close under the 10MA, which today is sp'1396.

The FOMC

Tomorrow's FOMC announcement will be the last scheduled major econ/news event of the year.

I will note..(for probably the thousandth time)...the 45bn of t-bond buying - which some are still touting as 'QE4', was already announced at the September FOMC, and I'm sure the Bernanke will follow through with his original statement of intent.

So..as at January 2013, op-twist will have ended (due to lack of short term bonds to sell), and the Fed will be printing out of thin air..85bn a month. 40bn for MBS, and 45bn for US Govt. t-bonds. That works out at a big 1 trillion per year.

Unless I'm mistaken, didn't the clown finance TV cheer leaders all proclaim the 'summer of recovery' in 2009? In which case, why is the Fed now about to ramp printing to an annual 1 trillion?

Oh that's right, the cheer leaders were lying..or were plain delusional. I hope its merely the latter.

Goodnight from a foggy*..and very icy London

--

*that's a bullish buy signal...right?