US indexes remain choppy, holding moderate declines, although we do have much more significant weakness in the R2K -1.6%, and the Trans -1.5%. VIX is +8%, but still 'only' in the mid 14s. Metals are mixed, Gold +$7, whilst Silver is fractionally red.

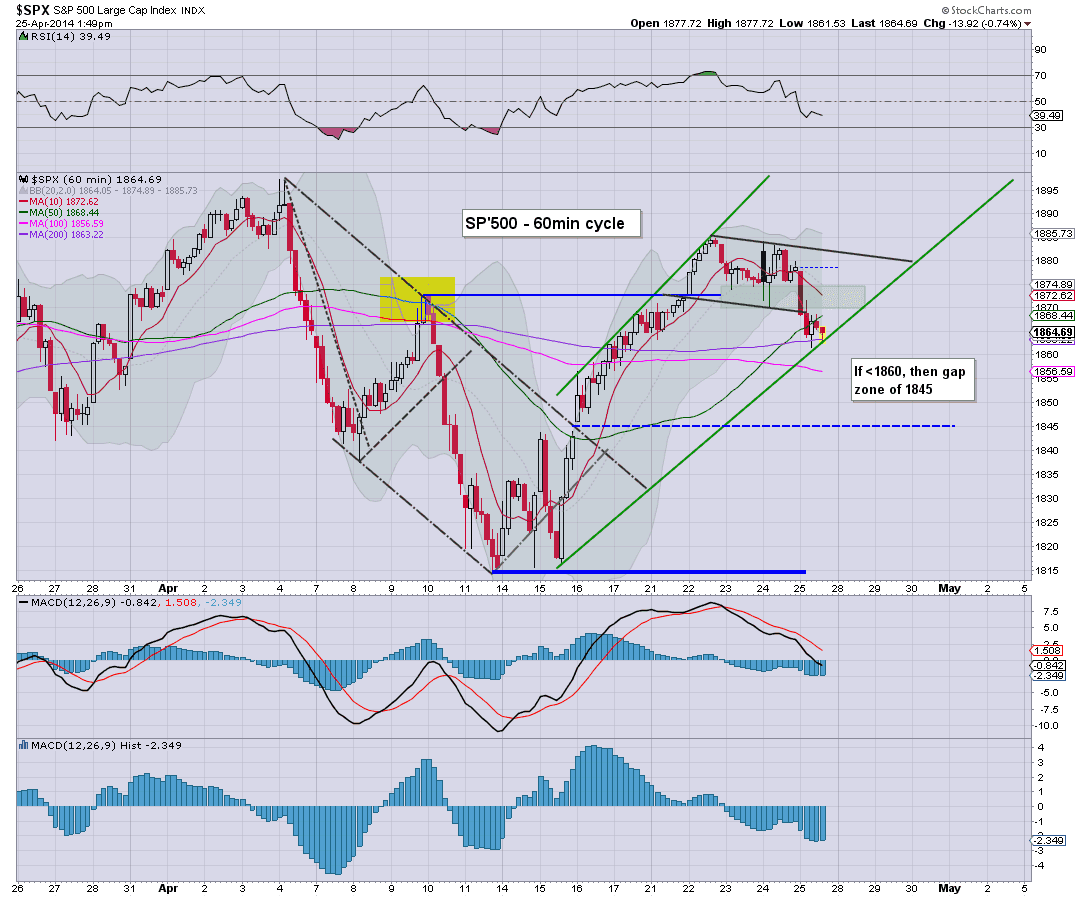

sp'60min

Summary

*Arguably, based on the past few weeks, today is an opportunity for those on the short side to bail into the weekend. I realise though, some will be calling for much lower levels next week.

-

So...some weakness to end the week, especially in the two leaders. Personally, I think everyone should be pleased with today. Bulls are getting a new entry level, whilst bears are getting a chance to bail at somewhat lower levels.

--

re: RIG. I continue to have a major interest in this stock..

exited LONG at 43.30...now have a new long-entry target of the low 42s next Monday.

Something I will consider across the weekend

-

2.16pm.. VIX is creeping higher....'weakness into the weekend'. but to be clear, I'd still be seeking the sp'1900s within the near term.

RIG continues to melt lower, and a re-purchase in the low 42s next Monday...very viable.

2.25pm.. new low. 1860..and here come the 1850s... there will be STRONG support at the 50 day MA of 1858, so we might get stuck there.

Regardless.. the weaker bull hands are getting washed out today.

-

2.42pm.. a spike floor. just above the 50 day MA? Hmm

I have to think bears are still getting an opportunity to exit here..before the 1900s.