The broader market remains in minor chop mode ahead of the Yellen. There is notable weakness in the Trans, -0.8% @ 8485. Net weekly gains still look probable for most indexes. USD is holding strong gains of 0.8% in the DXY 96.00s. Metals are flat, whilst Oil is sliding, -1.8%.

sp'daily5

Trans, daily

Summary

*VIX -0.7% in the low 12s... a touch above the earlier low of 11.91, but still... highly indicative of a market that is utterly not concerned about any 'spooky news' across the long weekend.

---

Well.. lets see what the algo-bots make of the Yellen.. I'd guess a prepared speech might appear as a press release at 1pm... rather than the market having to actually listen to her for an hour.

--

notable strength: AAPL +0.8% in the $132s.

With stocks like AAPL still clawing higher, there is little realistic hope for the bears into the weekly close.

-

standing by for the CEO of PRINT central....

--

1.02pm.. a lot of interesting comments flying across...

Naturally.. the use of 'Transitory' in reference to Q1 weak growth... as expected

Market reaction is largely muted... it bodes well for the equity bulls into the close.

-

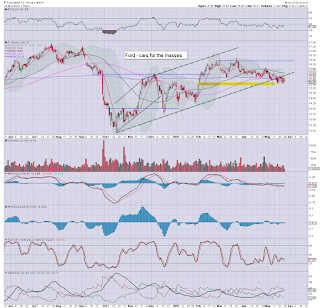

notable weakness, Ford (F), -1.3%... daily chart is not so pretty, a failure to hold the recent spike low would be a real problem.

stay tuned

-

1.11pm.. VIX notably breaks a new low for the year... 11.82... completely confirming the utter lack of market worry.

1.22pm.. Market chop.. as the Yellen continues.... with more use of Transitory.. and excuses about snow in winter.

Overall though... this is ideal fedspeak for Mr Market... ahead of the weekend.

USD is strong, now +1.0% in the DXY 96.20s.. as the Euro is distinctly weak.. set to lose €/$ 1.10s.

-

1.38pm.. Thus concludeth the Yellen..... Mr Market seems more than content.

Metals are a touch weaker, Gold -$2, Silver -0.6%...