Equities are increasingly weak as first support zone of sp'2100/95 fails to hold. VIX is reflecting some moderate market concern, +8% in the 13.90s, with upside to 14.25/50... likely equiv' to the spike low of sp'2085. USD has turned fractionally negative, and that is helping the metals, Gold +$2. Oil is failing to benefit though, -1.3%

sp'60min

VIX'60min

Summary

Interesting morning for the bears, but overall... how many times has the market seen morning weakness like this... and we remember how it usually ends, yes?

VIX continues to reflect a market that simply has near zero concern of anything, not even a possible end month Greek debt default and/or exit from the Euro.

-

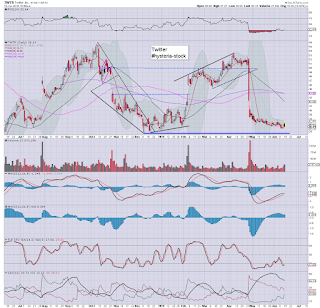

notable strength: TWTR +1.1%.. but still.. that is a lousy outcome after yesterday AH gains.

The daily black-fail candle sums up the messy situation.

--

weakness, oil/gas drillers, RIG -2.5%, SDRL -1.7%... as WTIC oil prices struggle, stuck within the $56/62 range.

*those seeking the sp'2140s and upward.. are going to need to see WTIC break into the $63s, the next set of inventory reports had better be another be major net draw downs.

11.15am... notable weakening in the USD, -0.3%..... having swung from early gains of +0.4%. Another 2-3 weeks lower in the USD...not long to wait until a viable mid term floor in the DXY 92/90 zone.

11.30am.. a minor up wave to sp'2099... with VIX rapidly cooling.

It remains somewhat messy, but who wants to be short ahead of Yellen next Wednesday?

11.33am.. INTC looking ugly, -1.3%, price structure is a clear bear flag.... bodes against upside into next week. Hmmmm