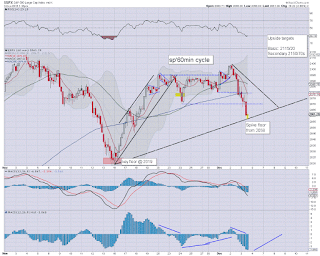

The sp'500 breaks a new intra low of 2059, decisively taking out the 200dma of 2064. USD remains severely weak, -1.9% in the DXY 98.10s. Oil is seeing a mini explosion to the upside, +3.4% in the $41s - with OPEC looming. Meanwhile, US bonds are notably weak, the ETF of TLT -2.7%.

USO'daily2

TLT, daily

Summary

*there is a great deal going on today.. hard to keep up.

For this hour.. I at least wanted to highlight bonds.. will likely cover them in far more depth in my late day post at 11pm EST.

Suffice to say.. bond prices are falling.. as yields are (naturally) on the rise.. ahead of the next FOMC.

--

As for equities... very difficult to call the close.

Clearly, the market will have massive excuse for a major move tomorrow... with the jobs data.

--

notable strength, RIG +4.3%... as oil climbs... and a short-stop cascade is likely underway. I remain LONG... seeking a higher exit in the $15s.

--

stay tuned!

1.19pm.. We have a viable spike floor from sp'2058.

Equity bulls should be battling for a daily close back above the 200dma (2064).