The sp'500 has cooled a little from the earlier high of 2052.. along with VIX clawing back upward from the new cycle low of 13.75. Oil is not helping, having swung from +2.0% to -0.4%... although the $44/45s look a very valid target next week. USD is +0.3% in the DXY 95.00s.

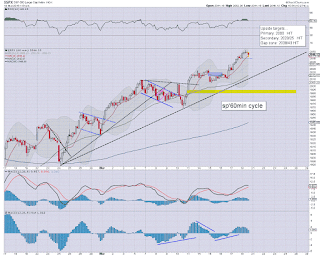

sp'60min

Summary

At the current rate, we'll see a bearish MACD cross in the closing hour.. or at the Monday open. It does bode slightly in favour of the bears.

Yet.. price action is little different than across the past few weeks. There is no sig' downside power right now.

If you believe Oil will manage to continue clawing upward to next resistance in the $44/45s, then it is reasonable to assume equities will at least 'hold together' until such time.

On that basis, I'm still holding off... although when I see things like TVIX jump from $5.28 to $5.53 in just a few hours, it does make me twitchy.

--

notable weakness... CAT, daily

Having climbed from the $56s (Jan 20th) to today's $76s... CAT is really starting to look tired. The underlying economic problems in the mining/energy sector remain key.. and CAT looks vulnerable.