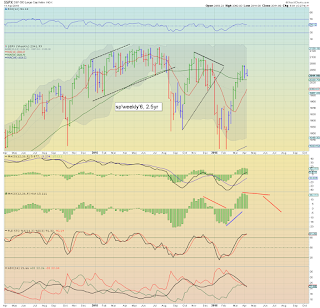

It was a pretty tedious day in the US equity market, with the sp'500 seeing early gains to 2062, but then a clear failure to hold above declining trend/resistance, a great deal of chop, and settling -5pts @ 2041. More broadly, the bigger weekly cycle is offering another subtle indicator that 2075 is a key mid term high.

sp'weekly6

sp'monthly1b

Summary

We now have two blue candles on the weekly 'rainbow' (Elder impulse) chart. That is certainly not 100% clarification of a key top, but its an important provisional warning.

Equity bull maniacs should be increasingly worried 2075 is indeed yet another 'marginally lower high'.. with a new lower low (<1810) due by late May/June.

re: monthly1b: equity bears should be fighting hard for an April close under the 10MA @ 2017. Anything <2K would give good clarity that May.. and more so - June... will be 'entertaining'.

--

Market/econ chatter from Schiff

--

Looking ahead

Tuesday will see import/export prices.

*Fed officials Harper and Williams will be on the loose during market hours.

--

Goodnight from London