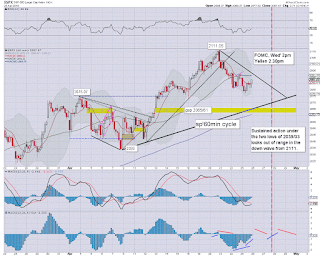

US equity indexes closed broadly weak, sp -3pts @ 2087. The two leaders - Trans/R2K, settled lower by -1.2% and -0.7% respectively. Near term outlook offers increasingly dynamic price action, with a very realistic decline to the sp'2040s - along with VIX spiking into the upper teens.

sp'60min

Summary

*closing hour action: micro chop... leaning slightly to the upside.

--

Certainly, not the most exciting of starts to the week, but then, with each hour closer to the FOMC announcement (Wed' 2pm).. the market is increasingly inclined to move into a holding pattern.

The lower gap zone of sp'2065/61 remains a starter target for the bears, and frankly.. considering the daily/weekly MACD cycles.. a move to the 2040s looks realistic for the weekly/monthly close.

I see just a few out there talking about the 2030/20s in the near term.. and I'd agree, those levels look a stretch, even given a few days into early May.

--

more later... on the VIX