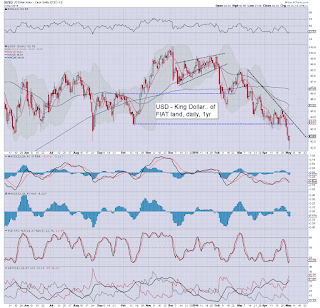

It was a rather interesting day in currency land, with the USD swinging from an early low of DXY 91.88, but settling +0.3% @ DXY 92.93. Broadly, the USD remains stuck in a broad 9% range from the giant 100 threshold to the 91s.

USD, daily

USD, monthly

Summary

The US and world capital markets have seen some truly insane crazy times since 2006.

I remember the Schiff touting dollar doom in 2006/07.. for some very valid reasons (the widening trade deficit being a primary one).

For a brief while it seemed like he might be right about the USD - as he was about the US housing market and equities, yet the USD floored in April 2008 @ DXY 71.33.

As world capital markets became deeply distressed into autumn 2008, the USD soared, and despite a few periodic cool downs (late 2009, early 2011) the USD is not remotely looking weak.

Far from imploding, the USD remains King of FIAT land.

No doubt, a few of you out there will disagree... and I'd merely reflect back 'so.. you think the Euro, Yen, British Pound, or Yuan are going to appreciate long term vs the USD?'

My long term outlook for the USD remains entirely unchanged, seeking a monthly close back above the DXY 100 threshold, and from there.... onward to the 120s.

--

Update on the German DAX, monthly

The loss of the 10K threshold should make the bull maniacs at least a little twitchy. Things don't get interesting until rising support in the 8900s is decisively broken under.

--

Looking ahead

Wed' will see a wheel barrow of data: ADP jobs, intl' trade, prod'/costs, PMI/ISM serv' sector, factory orders, and the latest EIA report.

--

Goodnight from London