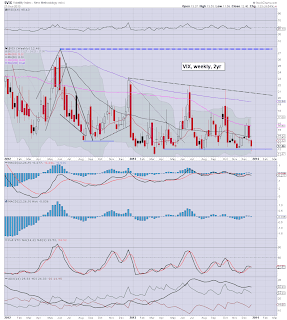

With equities seeing some significant follow through from the post QE-taper decision, the VIX saw a further very significant drop, declining by -9.6% across the week. VIX looks set to end 2013 in the 12/11 zone.

VIX'60min

VIX'daily3

VIX'weekly

Summary

More than anything, it is most notable that the VIX high for 2013 was a mere 21..whilst the 2012 high was 27.

It remains an Incredibly confident market, one which has little concern of the Fed easing off the paper printing peddle.

--

The only issue is when the VIX will break back into the 20s. When the market breaks lower in mid/late January, it will be fascinating to see if Mr Market gets spooked, or whether it will be just a series of small volatility gains into the upper teens.

As it is, I have no plan to go long volatility until the late spring at the earliest.

-

more later...on the indexes

Friday 27 December 2013

Closing Brief

The main indexes saw minor chop into the weekend, sp -0.6pts @ 1841. The two leaders - Trans/R2K, settled lower, -0.2% and -0.1% respectively. Near term outlook remains broadly bullish, with a viable year end close in the sp'1850/60s.

sp'60min

Summary

Well, it was a short trading week, but the bulls got the follow through they should have been seeking. With the break into the sp'1840s, and Dow 16500s, the primary trend remains very strong. For those bears seeking a 5-7% correction...the wait may only be another 2-3 weeks.

Have a good weekend everyone!

The usual bits and pieces across the evening.

--

*the weekend post will be on the US weekly indexes

sp'60min

Summary

Well, it was a short trading week, but the bulls got the follow through they should have been seeking. With the break into the sp'1840s, and Dow 16500s, the primary trend remains very strong. For those bears seeking a 5-7% correction...the wait may only be another 2-3 weeks.

Have a good weekend everyone!

The usual bits and pieces across the evening.

--

*the weekend post will be on the US weekly indexes

3pm update - net weekly gains

The smaller 5/15/60min index cycles are offering opportunity for a little jump higher into the close. Regardless though, equity indexes look set to close the week with net gains of around 1.5%. Equity bulls remain in full control. Momo stocks remain weak/cooling down.

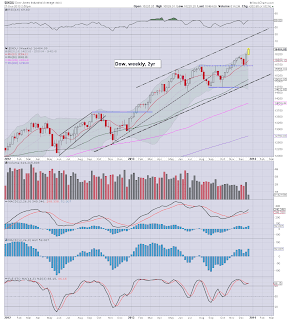

Dow, weekly

Summary

Without getting overly focused on the smaller cycles, there is reasonable chance of closing the week on a high.

--

*notable strength in the coal miners: BTU, ANR, JRCC

BTU, daily

--

updates into the close

3.07pm.. TWTR -9.3%.. the momo chasers getting nailed into the close...such a shame,

As ever, look for the VIX to get whacked lower in the closing minutes..happens more often than not.

3.18pm. TWTR -10.3% @ $65.75...there should be support in the 62/60 zone next Monday morning, before the madness starts climbing again.

-

3.43pm.. TWTR -12.0%....rats really getting the kick now!

Main market looks fine though, Dow/Sp' both set to close fractionally higher.

Dow, weekly

Summary

Without getting overly focused on the smaller cycles, there is reasonable chance of closing the week on a high.

--

*notable strength in the coal miners: BTU, ANR, JRCC

BTU, daily

--

updates into the close

3.07pm.. TWTR -9.3%.. the momo chasers getting nailed into the close...such a shame,

As ever, look for the VIX to get whacked lower in the closing minutes..happens more often than not.

3.18pm. TWTR -10.3% @ $65.75...there should be support in the 62/60 zone next Monday morning, before the madness starts climbing again.

-

3.43pm.. TWTR -12.0%....rats really getting the kick now!

Main market looks fine though, Dow/Sp' both set to close fractionally higher.

2pm update - momo stocks remain especially weak

Whilst the main market is largely just churning sideways into the weekend, the momo stocks remain weak. FB -1.4%, NFLX -2.9%, whilst the hysteria that is TWTR, -8.0%. VIX is +1.5%, but such a minor gain is to be dismissed as just the usual noise.

TWTR, daily

sp'60min

Summary

Certainly, the momentum is slipping in the hysteria/momo stocks, although with such a strong broad market, further highs look likely..even in TWTR.

--

It would seem the mainstream consensus for the broader market is what I was originally looking for...

...a short term peak in mid January, somewhere in the sp'1875/1900 zone. From there, risk of a 75/100pt drop..but that will barely get us into the upper 1700s again.

TWTR, daily

sp'60min

Summary

Certainly, the momentum is slipping in the hysteria/momo stocks, although with such a strong broad market, further highs look likely..even in TWTR.

--

It would seem the mainstream consensus for the broader market is what I was originally looking for...

...a short term peak in mid January, somewhere in the sp'1875/1900 zone. From there, risk of a 75/100pt drop..but that will barely get us into the upper 1700s again.

1pm update - continued minor chop

The broader market remains choppy, but there is certainly lots of interesting action going on. The momo stocks remain weak, with TWTR -6.5%. The shippers are stabilising after an early spike high - DRYS in the low $5s..now $4.80s, but set for the $6s by mid Jan.

sp'weekly'8

RIG, weekly

Summary

*I remain heavy LONG RIG, having added last Thursday in the 47.30s. I am seeking an exit next Friday in the 52/53 zone. Longer term upside looks to be the 70s though.

--

So.. a choppy market, but at least its not a boring end to the week!

I've not watched a minute of clown finance TV yet today, did I miss anything? ;)

TWTR now -7%...ohh the humanity!

VIX update from Mr R.

--

sp'weekly'8

RIG, weekly

Summary

*I remain heavy LONG RIG, having added last Thursday in the 47.30s. I am seeking an exit next Friday in the 52/53 zone. Longer term upside looks to be the 70s though.

--

So.. a choppy market, but at least its not a boring end to the week!

I've not watched a minute of clown finance TV yet today, did I miss anything? ;)

TWTR now -7%...ohh the humanity!

VIX update from Mr R.

--

12pm update - choppy end to the week

Equities are seeing continued minor chop, with particular weakness in some of the bubble/momo stocks like FB and TWTR. Metals are look weak, despite minor gains, Gold +$4. Shippers cooling off after early highs, DRYS -0.5% in the $4.60s. VIX is fractionally higher, but set to close red.

sp'60min

sp'daily5

Summary

Clearly, there is some resistance in the low sp'1840s..against the big channel..yet, I'm guessing that will be broken over next week.

The hourly MACD cycle is already kinda low, and there looks to be reasonable upside into the sp'1850s by the year end close next Tuesday.

*interesting strength in RIG, +1.9% in the $49s. Target by Jan'3 is 52/53.

--

time for tea :)

sp'60min

sp'daily5

Summary

Clearly, there is some resistance in the low sp'1840s..against the big channel..yet, I'm guessing that will be broken over next week.

The hourly MACD cycle is already kinda low, and there looks to be reasonable upside into the sp'1850s by the year end close next Tuesday.

*interesting strength in RIG, +1.9% in the $49s. Target by Jan'3 is 52/53.

--

time for tea :)

11am update - momo stocks are weak

Whilst the main market is now a touch lower, there is some noticeable weakness in the momo stocks. FB is -1.5%, whilst TWTR is -5.5%. Considering the recent gains though, these are still very minor retracements. Broader trend remains to the upside.

FB, daily

TWTR, daily

Summary

We're seeing a little weakness in the main market, but really, this is all minor noise, and any weekly close in the 1830s would still be another important weekly gain.

VIX +1% in the low 12s, a weekly close in the 11s is still viable if the market can ramp in the late afternoon.

--

*notable strength: BTU, RIG

DRYS is also cooling off a little after the earlier break into the low $5s.

FB, daily

TWTR, daily

Summary

We're seeing a little weakness in the main market, but really, this is all minor noise, and any weekly close in the 1830s would still be another important weekly gain.

VIX +1% in the low 12s, a weekly close in the 11s is still viable if the market can ramp in the late afternoon.

--

*notable strength: BTU, RIG

DRYS is also cooling off a little after the earlier break into the low $5s.

10am update - new day... new highs

The main indexes break to new highs, with sp'1840s and Dow 16500s. There is a touch of weakness out there though, and mixed chop seems likely today. The momo stocks are looking especially weak, with TWTR and FB both lower. Metals are vainly trying to bounce into year end.

Dow, daily

TWTR, daily

Summary

Hmm, hopefully...at least today won't be boring.

Regardless of any minor falls in the immediate term...broader trend looks exceptionally strong into first half of January.

--

*notable strength: DRYS, RIG.

Dow, daily

TWTR, daily

Summary

Hmm, hopefully...at least today won't be boring.

Regardless of any minor falls in the immediate term...broader trend looks exceptionally strong into first half of January.

--

*notable strength: DRYS, RIG.

Pre-Market Brief

Good morning. Futures are a fraction higher, sp +1pt, we're set to open at 1843. Equity bulls look set for a weekly close that provides significant follow through from last weeks whipsaw to the upside. Market looks set for another 2-3 weeks of upside..before a moderate wave lower into Feb.

sp'weekly'8

Summary

Well, Christmas is out of the way, and all that is left now is getting past the New Years nonsense.

There is little reason why we'll close lower today, and more so..many now recognise that the start of the new year will likely see a significant jump higher.

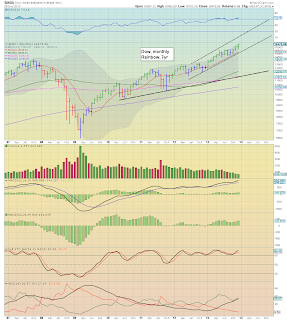

Keep in mind that the monthly charts will be offering Dow 17000s and Sp'1875/1900 in early January, which is something that even I thought not viable until March/April.

--

Notable early movers: DRYS +3.5% in the $4.80s. A weekly close in the $5s would bode for 6 or 7 by mid January, which is reminiscent of the old days.

TWTR -2.4% in the $71s

8.37am... DRYS breaks to $5.06 in pre-market trading. Are the 6s even viable today? lol

RIG showing moderate strength, +0.9% in the upper 48s. Next weeks target is 52/53

sp'weekly'8

Summary

Well, Christmas is out of the way, and all that is left now is getting past the New Years nonsense.

There is little reason why we'll close lower today, and more so..many now recognise that the start of the new year will likely see a significant jump higher.

Keep in mind that the monthly charts will be offering Dow 17000s and Sp'1875/1900 in early January, which is something that even I thought not viable until March/April.

--

Notable early movers: DRYS +3.5% in the $4.80s. A weekly close in the $5s would bode for 6 or 7 by mid January, which is reminiscent of the old days.

TWTR -2.4% in the $71s

8.37am... DRYS breaks to $5.06 in pre-market trading. Are the 6s even viable today? lol

RIG showing moderate strength, +0.9% in the upper 48s. Next weeks target is 52/53

The big shift that so few see

Another day higher for the US and world equity indexes. After a year where the old leader - Transports, is up around 39%, it remains truly bizarre to see the usual (online) suspects tout 'imminent doom'. No doubt they'll still be doing it at sp'1900, 2000...and so forth.

Dow' weekly

Dow'monthly'2, rainbow

Summary

Another good day for those who remain long and strong... equities. For those who are still unable to resist shorting the indexes..or who are long volatility, this remains a market of perpetual pain and bitter misery.

Holding to the original summer outlook

sp'weekly4 - hyper bullish outlook

The outlook continues to be a likely intermediate top next spring, before a sell down..not on recessionary concerns, but probably socio-political 'issues'. Regardless of how big a drop we see next summer/autumn, there looks to be extremely strong upside in the subsequent wave into late 2015/early 2016.

The Nikkei is starting to break out

As expected, we're seeing the first sign of a clear break into the 16000s. A January close >16k, will be enough to confirm that 17/18k, and 20k will eventually be hit..although the latter not until 2015. If the deflationary mess that is Japan can keep pushing higher, the stronger economies of the USA and Germany will no doubt do far better.

Looking ahead

The only thing due tomorrow is the EIA Oil and Gas inventory reports, not that those will of much interest to anyone.

*there is no sig' QE until January.

-

Evolve...or die.

There is now a clear fundamental shift going on in the World capital markets, and many are still utterly failing to see it..or are in complete denial about it. Even the cheer leaders on clown finance TV haven't the slightest inkling of what is right before their eyes. Then we have the US Dollar doomers - which even includes Peter Schiff, still touting hyper-inflation, all whilst money velocity remains low, and is itself still falling.

Very few see what is happening, but then...when in history have the mainstream ever understood what is going on..until some years has passed?

So, go ahead and short this market...and see how that works out for you. Equity bears had TWO last chances this summer to keep the broader bearish scenario viable, and have failed in both instances. Here is a closing thought to end another bullish day...how about we NEVER go below sp'1500...EVER...AGAIN ? How does that sound?

Goodnight from London

Dow' weekly

Dow'monthly'2, rainbow

Summary

Another good day for those who remain long and strong... equities. For those who are still unable to resist shorting the indexes..or who are long volatility, this remains a market of perpetual pain and bitter misery.

Holding to the original summer outlook

sp'weekly4 - hyper bullish outlook

The outlook continues to be a likely intermediate top next spring, before a sell down..not on recessionary concerns, but probably socio-political 'issues'. Regardless of how big a drop we see next summer/autumn, there looks to be extremely strong upside in the subsequent wave into late 2015/early 2016.

The Nikkei is starting to break out

As expected, we're seeing the first sign of a clear break into the 16000s. A January close >16k, will be enough to confirm that 17/18k, and 20k will eventually be hit..although the latter not until 2015. If the deflationary mess that is Japan can keep pushing higher, the stronger economies of the USA and Germany will no doubt do far better.

Looking ahead

The only thing due tomorrow is the EIA Oil and Gas inventory reports, not that those will of much interest to anyone.

*there is no sig' QE until January.

-

Evolve...or die.

There is now a clear fundamental shift going on in the World capital markets, and many are still utterly failing to see it..or are in complete denial about it. Even the cheer leaders on clown finance TV haven't the slightest inkling of what is right before their eyes. Then we have the US Dollar doomers - which even includes Peter Schiff, still touting hyper-inflation, all whilst money velocity remains low, and is itself still falling.

Very few see what is happening, but then...when in history have the mainstream ever understood what is going on..until some years has passed?

So, go ahead and short this market...and see how that works out for you. Equity bears had TWO last chances this summer to keep the broader bearish scenario viable, and have failed in both instances. Here is a closing thought to end another bullish day...how about we NEVER go below sp'1500...EVER...AGAIN ? How does that sound?

Goodnight from London

Subscribe to:

Posts (Atom)